Best mortgage calculator with extra payments

Our calculator includes amoritization tables bi-weekly savings. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

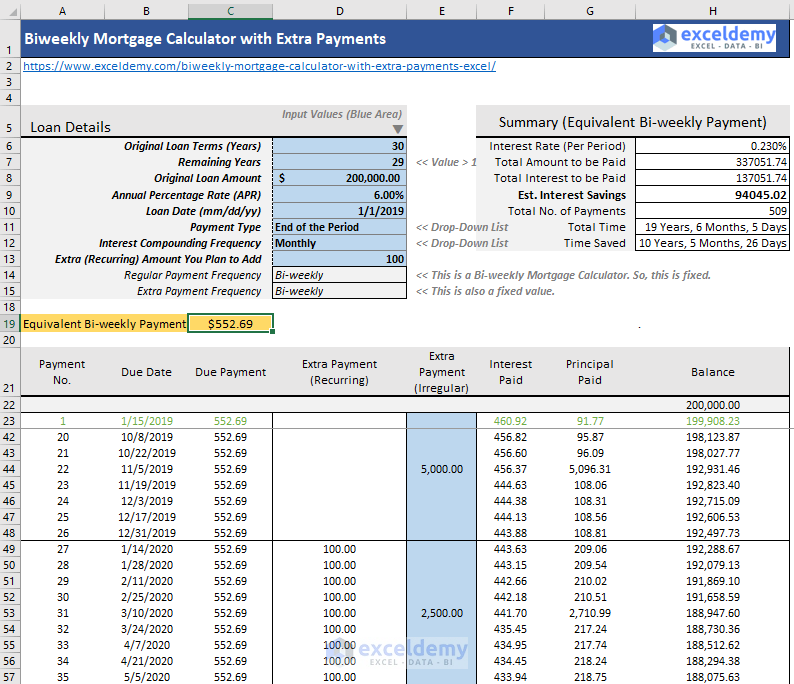

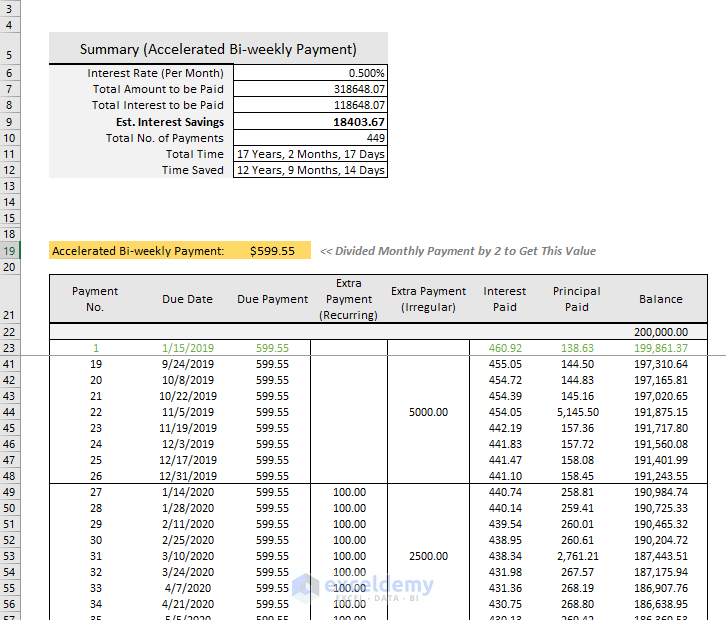

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

See how those payments break down over your loan term with our amortization calculator.

. September 6 2022 Monthly mortgage payments. 360 original 30-year term Interest Rate Annual. Finding the 1010 Perfect Cheap Paper Writing Services.

Another technique is to make mortgage payments every two weeks. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly.

So for example if you were being offered a mortgage rate of 225 the lender might do a stress test to see if you could still afford payments at the qualifying rate of 525. Bi-weekly payments help you pay off principal in an accelerated fashion before interest has a chance to compound on it. Its popularity is due to low monthly payments and upfront costs.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. For example if you are 35 years into a 30-year home loan you would set the loan term to 265. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Extra Payment Mortgage Calculator. 30-Year Mortgages and Extra Payments. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Biweekly paymentsThe borrower pays half the monthly payment every two weeks. Ultimately significant principal reduction cuts years off your mortgage term. 9 Promises from a Badass Essay Writing Service.

Pay this Extra Amount. Monthly payments start on. If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower.

A six percent ARM can skyrocket to eleven percent in as little as three years. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Use our free mortgage calculator to estimate your monthly mortgage payments.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Professional Case Study Writing Help. Youre probably familiar with refinancing but you may not have heard about mortgage recastingWhen recasting you make one large lump-sum payment toward your principal.

Mortgage loan basics Basic concepts and legal regulation. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals. Semi-monthly mortgage payments are not the same as bi-weekly mortgage payments.

How much extra payment should I make each month to pay off. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. Home buyers can shave years off their loan by paying bi-weekly making extra payments.

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Four alternatives to paying extra mortgage principal. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal.

Bi-weekly mortgage payments work best when you are paid every other week and your income is high enough to support the payment. Get rid of PMI or MIP January 28. Mortgage Amount or current balance.

The stress test ensures that you can still afford your mortgage payments at a higher mortgage rate which is called the qualifying rate and is set by the Bank of Canada. If the first few years have passed its still better to keep making extra payments. The Best Mortgage Refinance Companies for 2022 June 9 2022 Down payment assistance programs in every state for 2022 August 2 2022 FHA mortgage insurance removal.

After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023. Check out the webs best free mortgage calculator to save money on your home loan today. The calculator lets you find out how your monthly.

Extra payments count even after 5 or 7 years into the loan term. Extra Payments In The Middle of The Loan Term. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Lower payments and rates early in the loan term allowing borrowers to buy larger more expensive homes. In the early years of a longterm loan most of the payment is applied toward interest. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. It is easier to match your largest expense mortgage payment to your income when the payment period matches your pay period. Your 1 Best Option for Custom Assignment Service and Extras.

With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan.

As Close to 100 As You Will Ever Be. Rates and monthly payments can rise dramatically over the course of a 30-year commitment. How Do Biweekly Mortgage Payments Work.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Account for interest rates and break down payments in an easy to use amortization schedule. For example you might make a payment on the 1st of the month and another payment on the 15th of the month.

How to Use the Mortgage Calculator. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. With a semi-monthly mortgage payment your mortgage payment will be made two times per month.

Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs. Consider how long you plan on living in the home. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Semi-monthly mortgage payments split every month into two. There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments.

Mortgage Calculator For Extra Payments On Sale 51 Off Www Wtashows Com

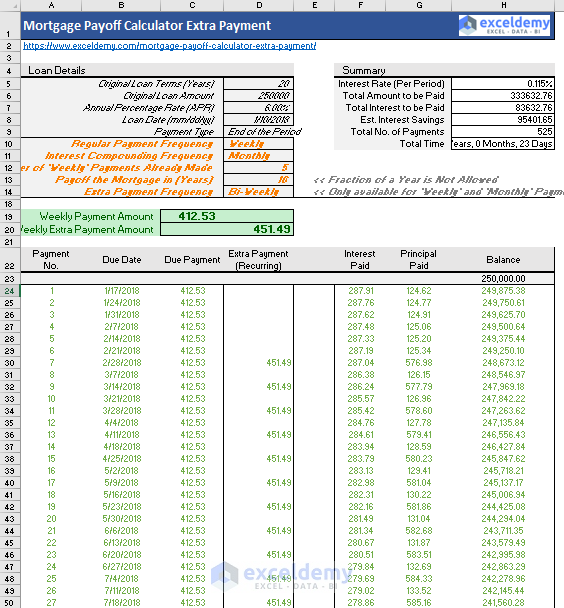

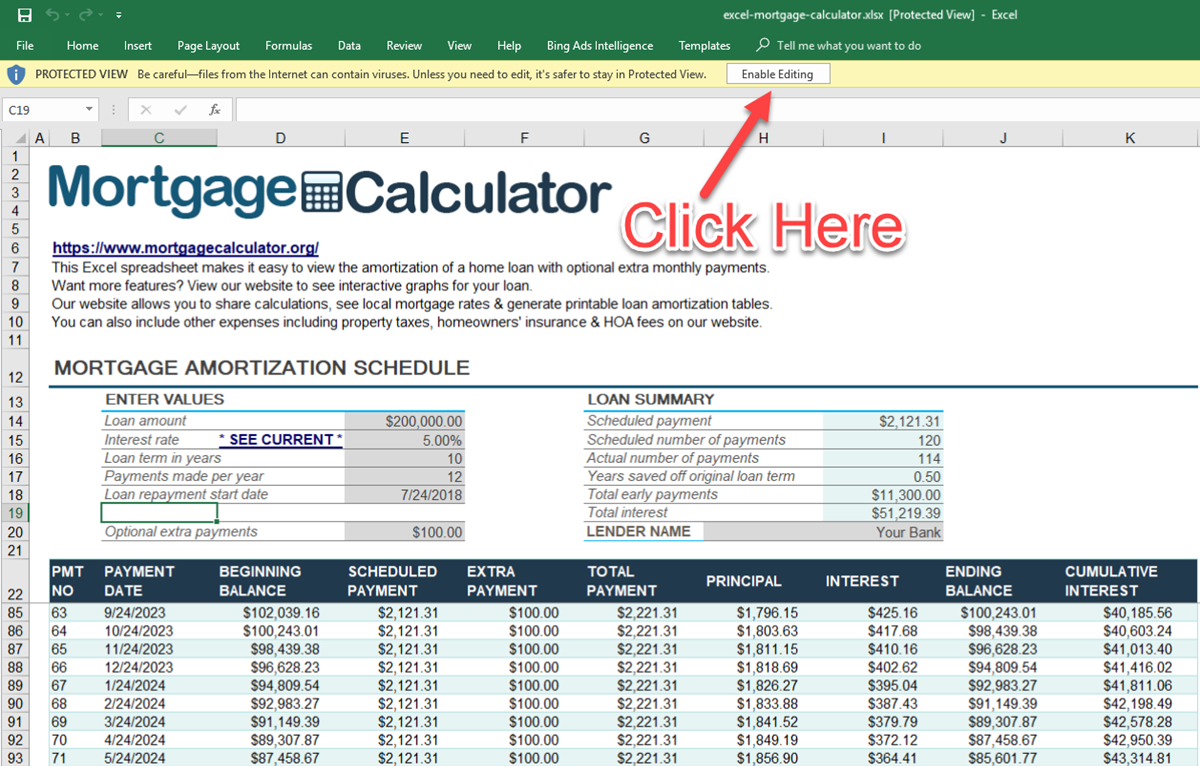

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Free Interest Only Loan Calculator For Excel

Extra Payment Mortgage Calculator For Excel

Mortgage With Extra Payments Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator For Extra Payments On Sale 51 Off Www Wtashows Com

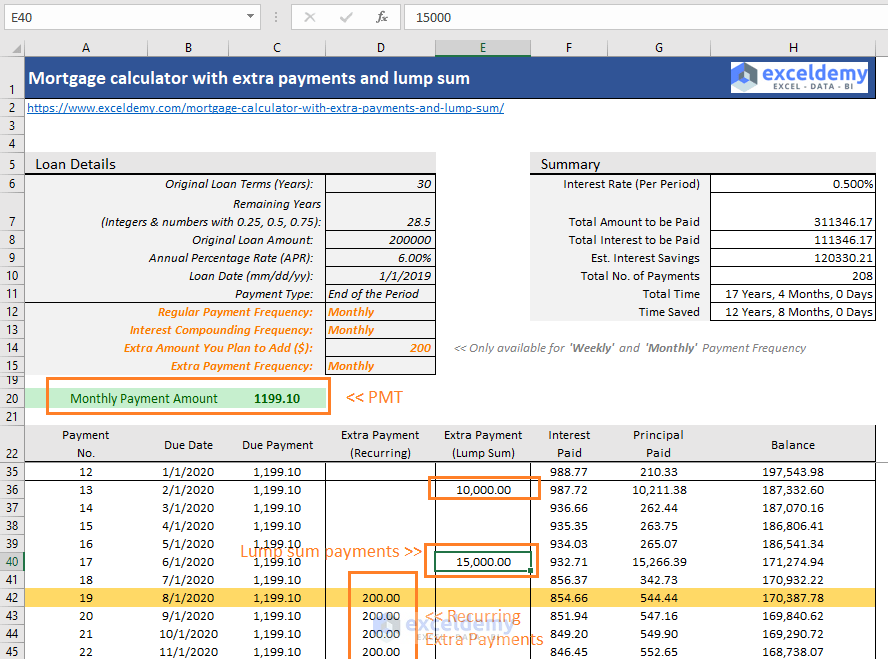

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

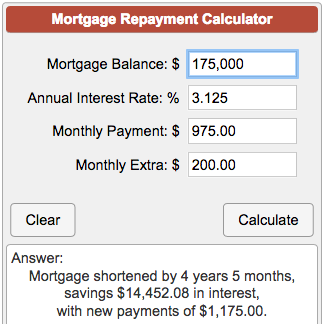

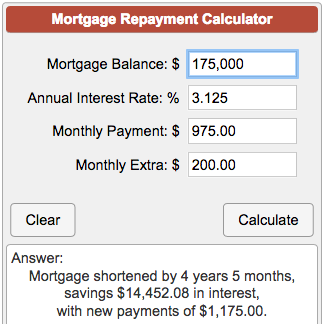

Mortgage Repayment Calculator

Extra Payment Calculator Is It The Right Thing To Do

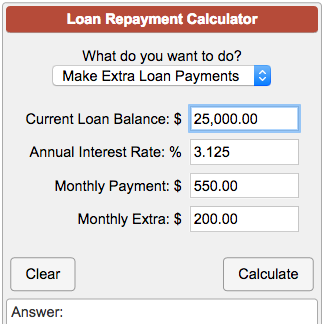

Loan Repayment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Extra Payment Calculator Is It The Right Thing To Do

Loan Calculator With Extra Payments Mycalculators Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template